Looking to list your ERC20 token? We’ll take you through an easy-to-follow guide to get listed on the Incognito pDEX, the first privacy-focused decentralized exchange.

The pDEX has no listing fees or KYC required. Once you’ve added liquidity for your token, you’ll be able to swap your token with BTC, ETH, USDT, USDC and other tokens and coins.

Ready? Here we go.

Step 1: Download the Incognito wallet.

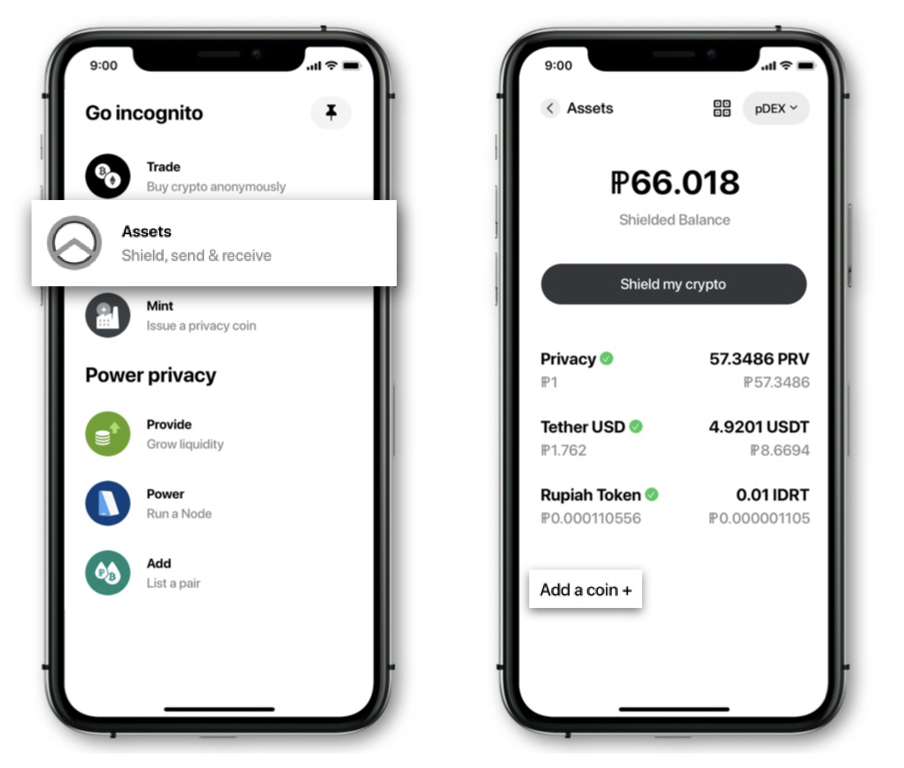

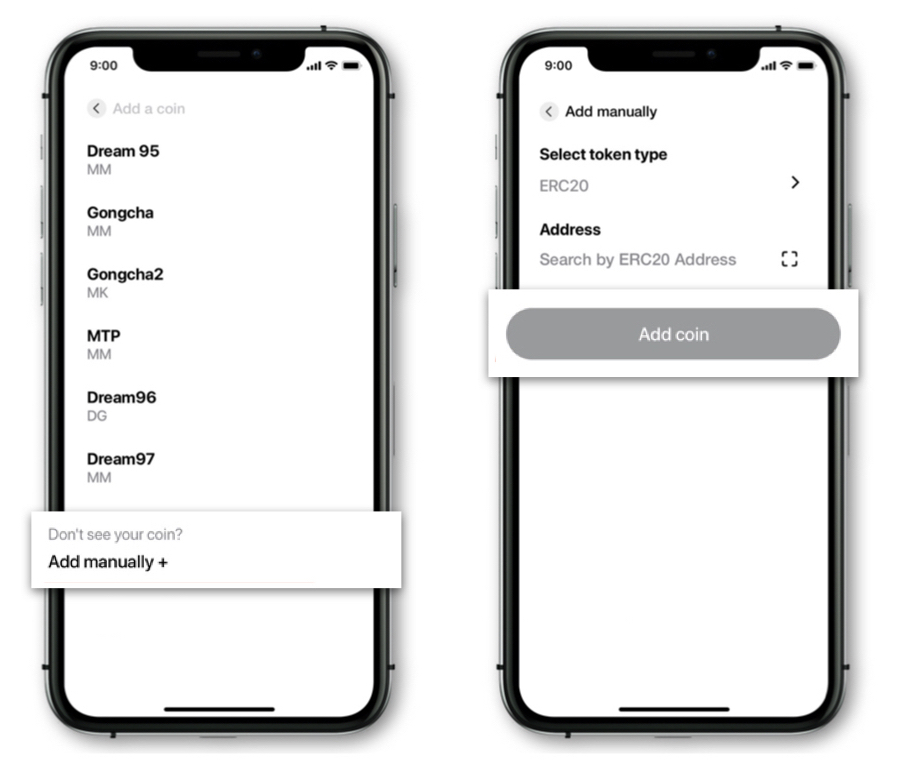

Step 2: Add your project token to the Incognito wallet.

Open the wallet, choose “Assets” on the main screen, then tap “Add a coin +” to add your token.

Choose “Add manually”, select token type and input the ETH token address or BEP2 original symbol.

Tap “Add coin” and your token will appear in your Incognito wallet.

Step 3: Calculate your liquidity pool.

Before you add liquidity, you should first calculate how much to put into your liquidity pool.

Users will access your liquidity pool to buy and sell your tokens. A larger liquidity pool means it has the capacity to hold more of your tokens and give better rates for your users. If someone was looking to buy 2,000 of your tokens, but your liquidity pool only holds 200, the transaction cannot take place. You can check out a more detailed explanation of liquidity pools and price determination on the pDEX here in this article.

We recommend projects to have at least 1,000 USD in the total liquidity pool, which means 500 USD worth of PRV, and 500 USD worth of your token.

Decide how much total liquidity you want to provide and calculate the amounts for both PRV and your token needed to set up your liquidity pool.

PRV amount = Total liquidity pool / 2 / Actual PRV price (check on the incscan.oi).

You token amount = Total liquidity pool / 2 / Your token price.

You will need these amounts in Step 4 and Step 5.

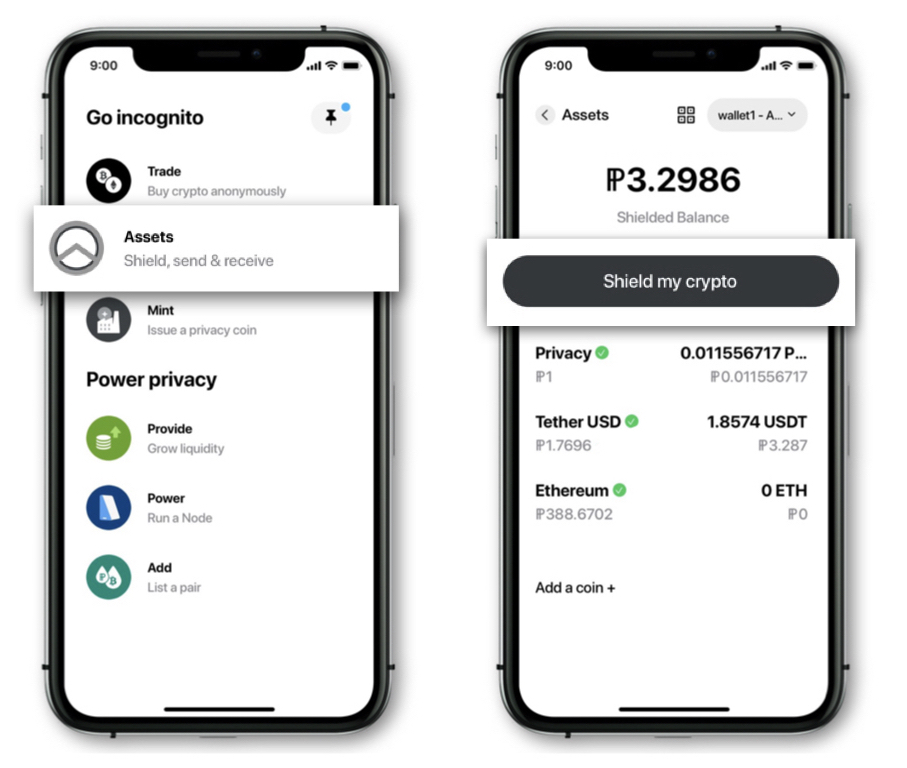

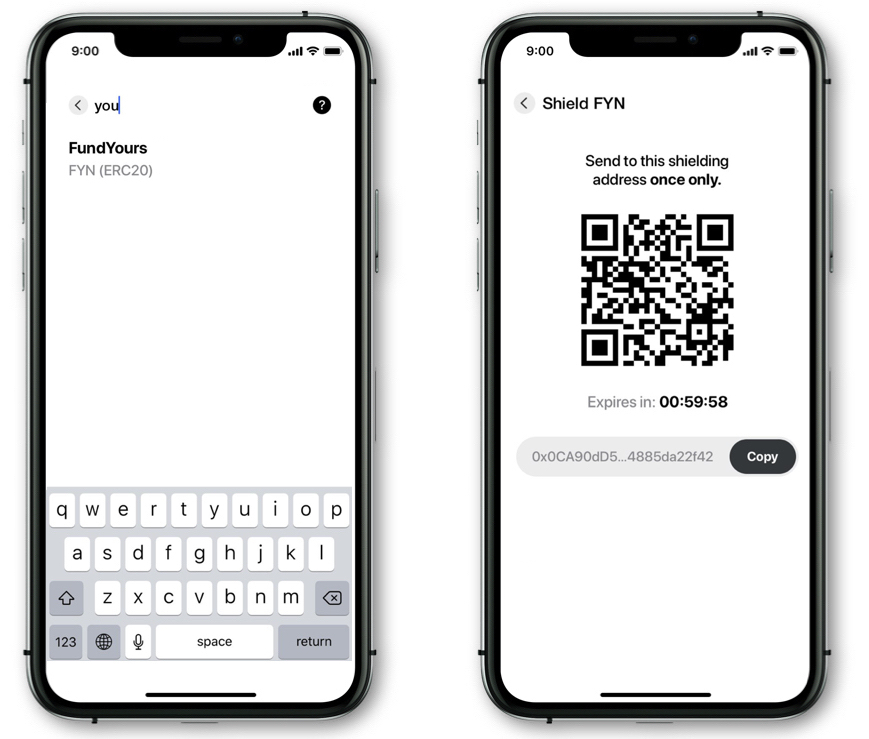

Step 4: Shield your tokens.

Select “Assets” from the main menu, then tap the “Shield” button to deposit your tokens into the Incognito wallet.

Choose your token from the list and copy the wallet address.

Send the calculated amount of your tokens (from Step 3) to the address shown in the Incognito wallet.

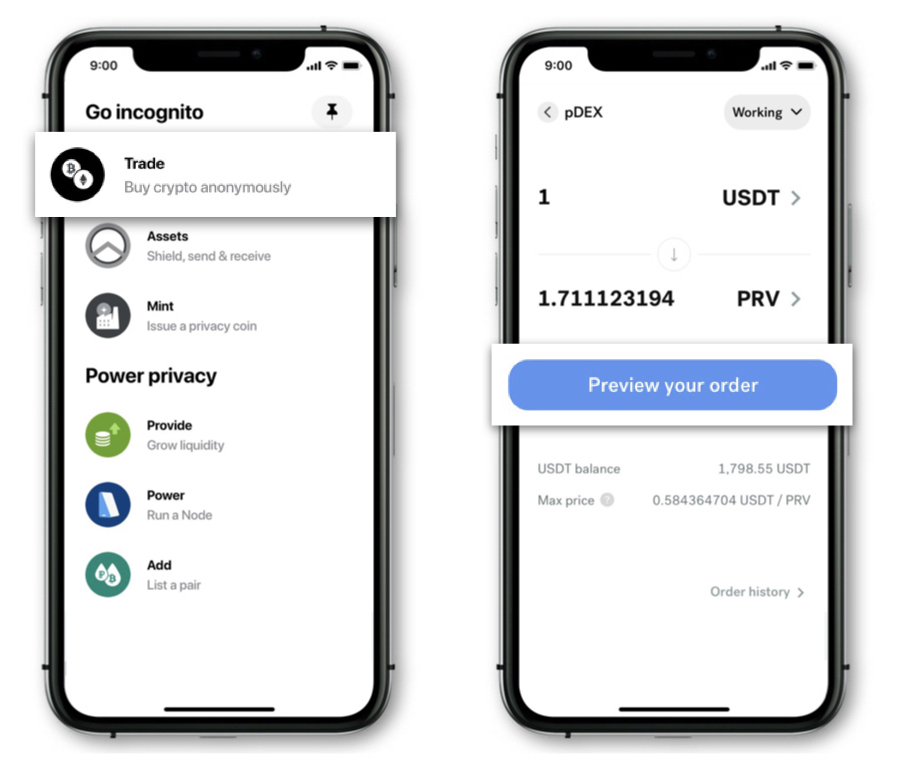

Step 5: Buy PRV to create liquidity for your token against the PRV token.

Maintaining a trading pair with PRV will allow Incognito to use PRV liquidity as a gateway to trade your token against BTC, ETH, BNB, USDT/USDC and more – without the need to add liquidity to these pairs. List one pair, trade with any coin.

Shield tokens you would like to use for buying PRV. Refer to Step 4.

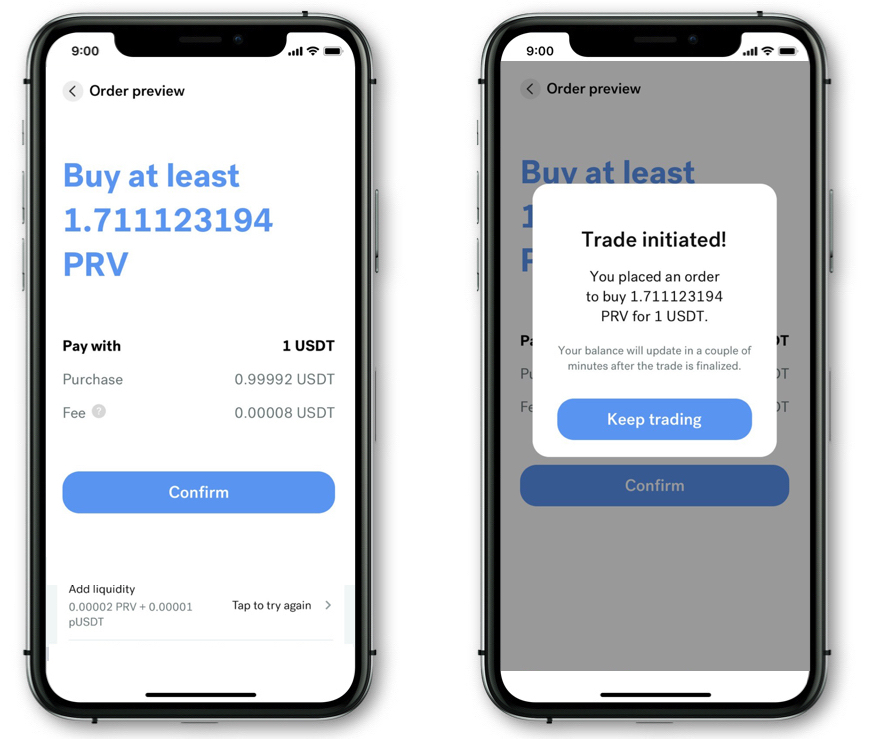

Tap “Trade” on the main menu. Choose a pair you would like to trade, check the PRV amount you will receive (calculated in Step 3), then click “Preview your order”.

Double check all your details on the confirmation page and click “Confirm”.

Done – your trade will be executed in a matter of seconds.

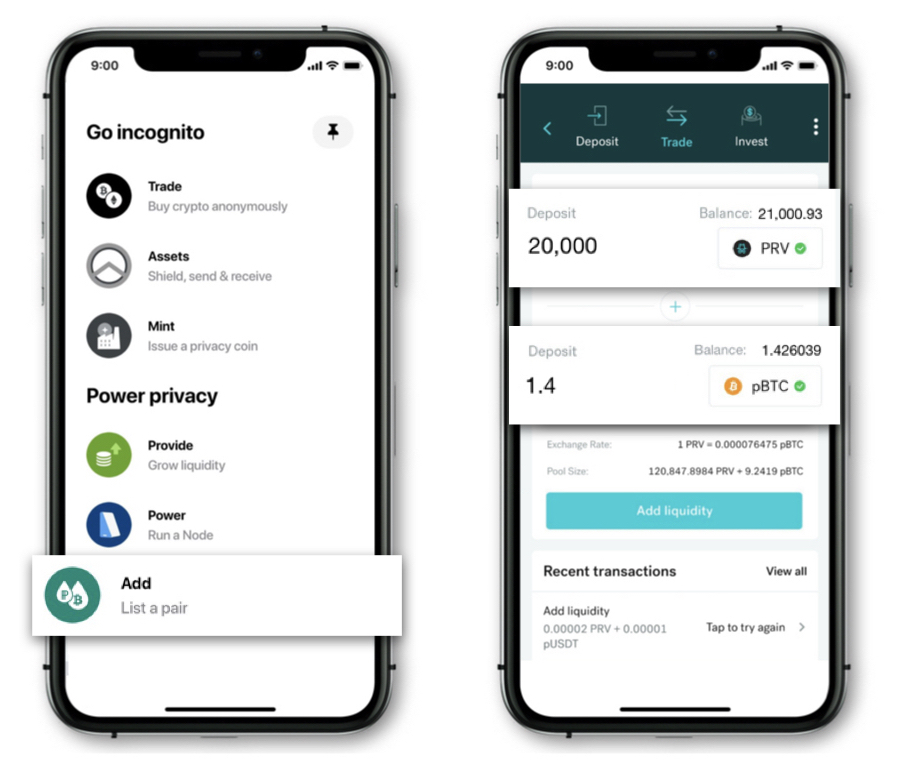

Step 6: Add liquidity from your trading funds.

You’ve got your PRV, you know how much to put into your liquidity pool – now it’s time to put that into action.

Select “Add” on the main menu, enter the respective calculated amounts of PRV and your token. Then tap “Add liquidity” at the bottom of your screen.

If, for any reason, you would like to withdraw your liquidity pool, you may do so at any time. There is no lock-up or limitations.

Step 7: Get verified.

if you want to see your token trading on the incscan.io, fill in this form and verify your token. Our team will review and get back to you within 1-2 business days.

You’re now all set! Congratulations on getting your token successfully listed!