Incognito’s goal is to deliver privacy, not just for digital assets, but also the financial applications that give them utility. Those who follow Incognito development will have seen the dev team working on certain building blocks – bridges to Ethereum, Binance Smart Chain, Polygon, etc. and privacy for apps like Pancake and Uniswap.

Multi-chain support is one of Incognito’s stronger points. However, these building blocks are still disparate, and as a result, so is the Incognito ecosystem. Liquidity for example, is fragmented across different chains, UX suffers, and traction is stunted.

This next stage of core development will establish seamless relationships between every privacy app and token on Incognito – a privacy hub for web3.

Unified pTokens

pTokens will no longer be tied to a given chain. For example, pETH will be the unified token for shielded ETH – whether that’s via the Ethereum bridge or the Polygon bridge. Unified pETH will be usable across different pApps, regardless of the chain those apps are bridged from. pETH holders will similarly be able to unshield ETH to the chain of their choosing.

This will bring significant UX benefits and open up new possibilities.

More utility for shielded tokens

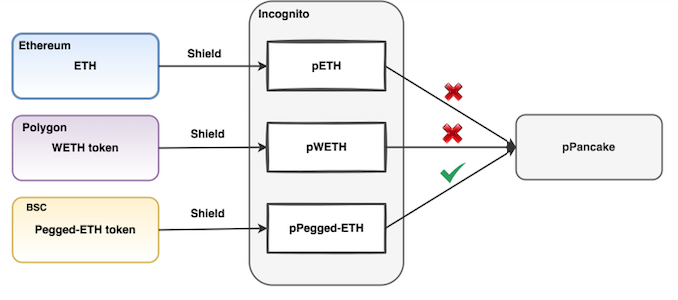

In the current system, shielded tokens are specific to their originating chain, which isn’t just a headache to manage, but also restricts the applications they can be used in. For example, pETH shielded from the Ethereum Chain cannot be used in pPancake, a Binance Smart Chain application.

Figure 1: Current shielding process

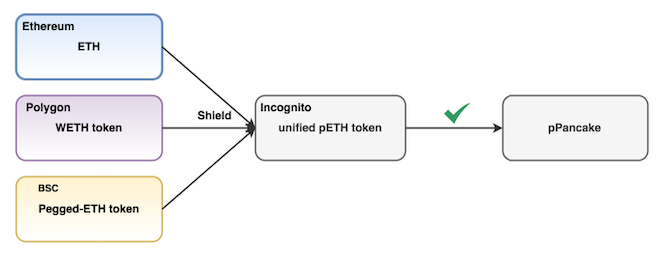

In contrast, a unified pToken can be used in all pApps, regardless of which bridge is used to shield the public coin.

Figure 2: Improved shielding process

Making liquidity more liquid

Currently, liquidity added to the Incognito exchange is fragmented. It’s less than ideal for traders, as well as inconvenient for liquidity providers.

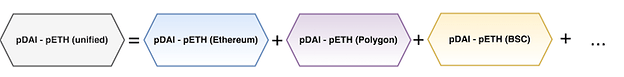

For example, liquidity for pETH/pDAI might be fragmented into pETH (Ethereum) / pDAI (Ethereum), pETH (BSC) / pDAI (BSC), pETH (BSC) / pDAI (Polygon), etc.

To state the obvious, a unified pool of pETH/pDAI will result in lower slippage due to higher liquidity. Unified pTokens will also allow liquidity providers to add liquidity to the same pool, even if they shield public coins via different bridges. It’s a far more efficient way to use and grow liquidity.

Figure 3: Federating liquidity on the Incognito exchange

More flexibility for unshielding (and for other chains)

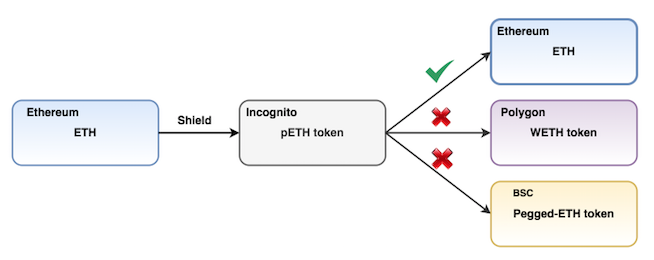

In the current design, unshielding is inflexible and often costly. For example, a user cannot unshield pETH (ETH) via the Polygon bridge to reduce fees – only Ethereum. pETH (ETH) also cannot be unshielded for use in Polygon dApps.

Figure 4: Current unshielding process

Unified pTokens allow greater flexibility – not just on Incognito, but for privacy advocates on any chain. They can hold their tokens privately and exit easily to any chain that supports that currency.

Figure 5: Improved unshielding process

Key differentiators for Incognito

Every project in this industry has its strengths and weaknesses. Our focus is on building privacy-first infrastructure that allows these projects to lean on each other, giving any privacy-minded individual more opportunity and utility. We think we are well positioned to do that.

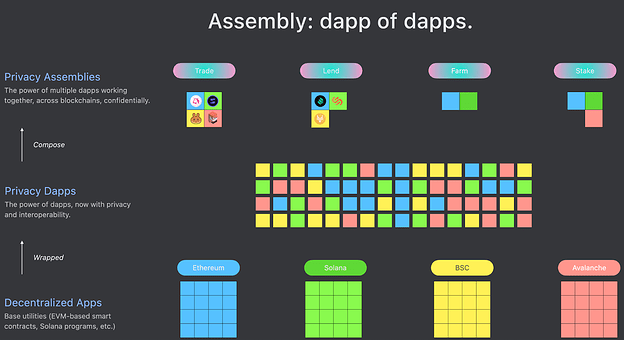

Made possible by unified pTokens, the first two pieces of essential infrastructure are the Privacy App Hub, and Privacy Assemblies.

Privacy Apps

Incognito will offer a central place where anyone can privately use any dApp – regardless of which chain they’re built on. People are often told that there’s tradeoff between privacy and convenience. We don’t think that has to always be the case.

Within the Incognito hub, every app and token with smart contract support is interoperable. For example, after shielding DAI from Binance SmartChain (BSC), a user can use pDAI in Uniswap on Polygon, or lend with Solend on Solana, without the typical swaps or conversions needed.

Privacy Assemblies

Most interoperability solutions for dApps aim to solve single use cases for single platforms. For example, 1inch focuses on liquidity aggregation. Although its reach extends to popular networks like Ethereum, Polygon, BSC, etc, it only can aggregate liquidity from DEXs within the same platform.

In contrast, Privacy Assemblies will allow each swap to utilize liquidity from all DEXes on all supported networks. A pToken swap can be calculated and split into multiple smaller swaps if needed, then traded on different DEXs across different platforms to achieve better rates.

Using the example above, there are two main parts to this.

-

pApp developers build a routing engine to determine a trading route to achieve the best rate from liquidity of all DEXs across all supported platforms.

-

Incognito protocol supports a general workflow to adopt the trading route as the swap input. The input provides instructions for the protocol to know whether it needs to split a swap into multiple ones, prior to broadcasting them to the smart contracts of targeted DEXes in order to execute trades.

The Incognito team will be the pApp developers in this early stage, but any 3rd party developers can build their own pApp (with their own routing engine, for example). They can then integrate with existing dApps in supported platforms by utilizing the open Incognito protocol. Potential use cases extend beyond swaps to a range of other smart contract powered applications (e.g. lending, governance, etc).

Conclusion

The next stage of Incognito development will be focused on unifying disparate pieces of the Incognito ecosystem, aiming to improve UX, utility, and efficiency. This work will affect main functionalities such as shielding, liquidity provision, trading, unshielding, and interaction with pApps. We hope to have your support as we build, test, and push this out to the world.

In the following topics, we’ll be breaking down the ideas suggested here in more detail, exploring how they’ll work in practice, and detailing potential challenges.

Looking forward to hearing your thoughts. Thank you!

I have a question.

I have a question.  That’s the potential challenge I mentioned in the Conclusion section. Basically, most platforms that support multi-network withdrawal (Binance for example) also encounter the challenge as withdrawal demand to a network is far higher than others. One solution we were thinking of is to have an incentive for people who will shield to “high demand” vaults and unshield from “low demand” vaults in order to rebalance assets among vaults. We are still working on a design for the incentive and will publish it in the next topic.

That’s the potential challenge I mentioned in the Conclusion section. Basically, most platforms that support multi-network withdrawal (Binance for example) also encounter the challenge as withdrawal demand to a network is far higher than others. One solution we were thinking of is to have an incentive for people who will shield to “high demand” vaults and unshield from “low demand” vaults in order to rebalance assets among vaults. We are still working on a design for the incentive and will publish it in the next topic.