On July 9, 2020, we introduced a way to supply liquidity to the pDEX that enables anonymous trading. It’s the well-known Provide feature, which allows PRV yield farming when you provide select coins for single-sided liquidity. Since Provide launched, it has become a high demand feature, and community members have used it to grow pDEX liquidity to a TVL of ~$29,572,028.

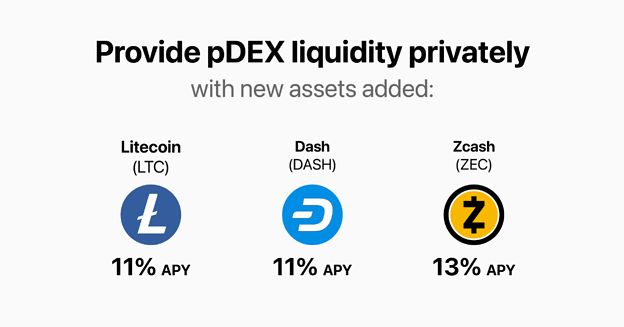

Today, we’re excited to broaden the scope of Provide by announcing rates for new coins. Starting from the effective dates below, you will be rewarded for providing liquidity for Litecoin, Dash, Zcash, and Dogecoin, directly in the app.

New rates and effective dates:

| PROJECT, COIN | PRV APY | |

|---|---|---|

| Effective date 2021-02-02 | ||

| Litecoin, LTC | 11% | |

| Dash, DASH | 11% | |

| Zcash, ZEC | 13% | |

By adding liquidity to any of the listed coins in Provide, you enable private trades on the Incognito pDEX and contribute to the growth of the privacy ecosystem. Thanks for protecting privacy  !

!

Notice: To sustainably allow for a higher volume with the new coins, we’re adjusting the APY to 10% for BTC and 21% for PRV, starting Feb 9, 2021.

02/05 UPD Since the Announcement release we’ve got lots of reasonable feedback related to the negative aspects to supply liquidity for DOGE through the Provide option, so we decided to postpone launch for this particular pool.

Start earning

To use the Provide feature, open your app and tap “Provide” on the home screen (in the “Power privacy” section).

Tap the “Provide more”/“Provide now” button, then select the currency you want to add. You can find a more detailed guide in the Helpful tutorials section below.

Glossary

Total Value Locked (aka TVL) is the most important indicator to evaluate the adoption of a DeFi project by calculating the total USD value of all assets locked in the corresponding smart contracts.

Helpful tutorials

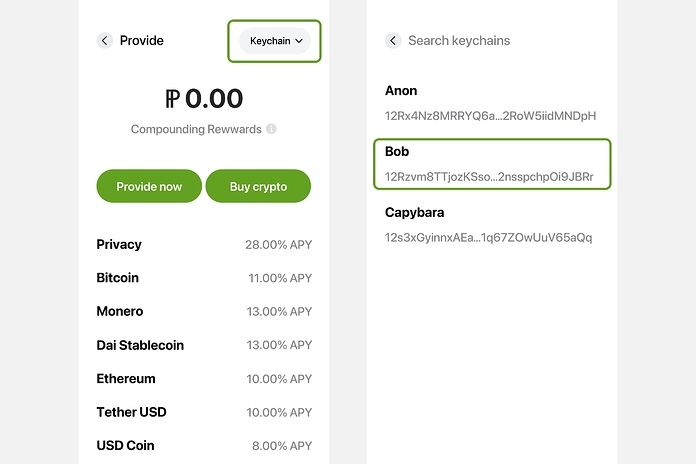

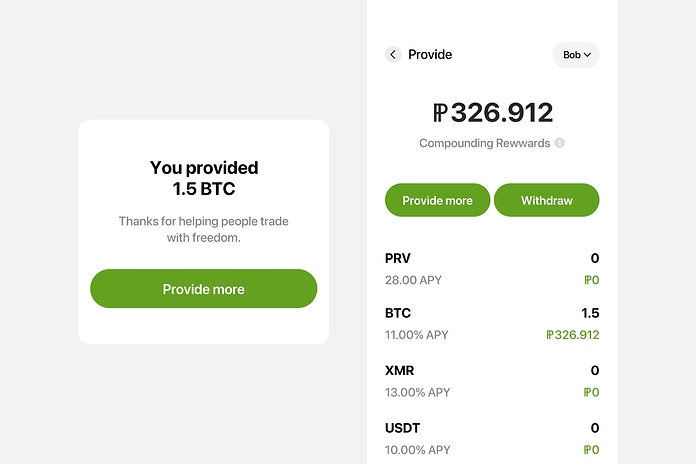

Select the keychain you want to use Pool with. You can find the list of your keychains in the top right corner of the screen. This will be the keychain you contribute funds from, and withdraw funds to.

Please note: If you previously used Node Pool, your funds will be in your pStake keychain. It may be more convenient for you to withdraw those funds to a keychain you use more frequently.

Here, let’s use our keychain ‘Bob’.

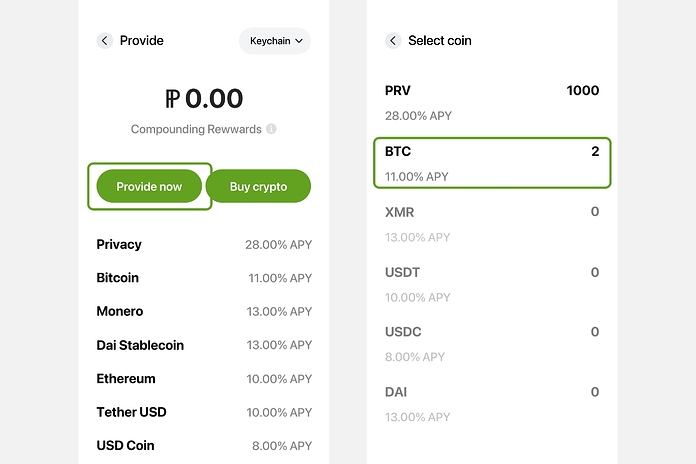

Tap on ‘Provide now’, then select the currency you wish to provide. You’ll see the balance you have of each currency, associated with the keychain you previously selected. Need to top up? Just tap ‘Buy crypto’ to head on over to the pDEX.

Let’s select BTC.

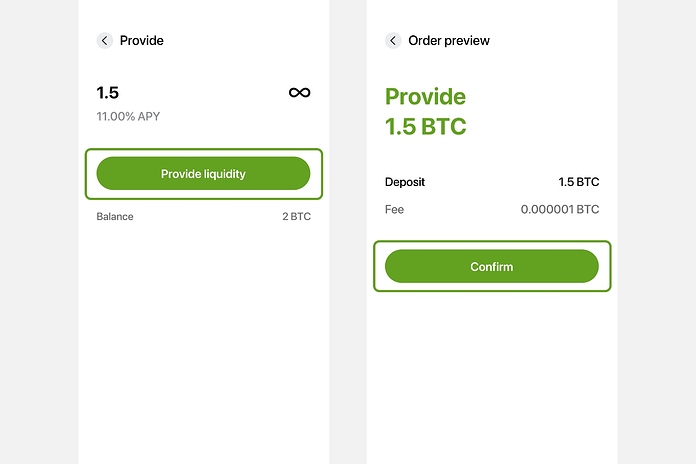

Here, enter the amount you wish to provide. Make sure everything’s in order, then tap ‘Confirm’.

Hurray! You’ve successfully provided liquidity and will start earning rewards.

Keep track of your rewards and balances from the main Provide screen, where you’ll see your total interest earned across all provided currencies. You can withdraw these rewards at any time. If you wish to remove liquidity, please allow up to 3 days.

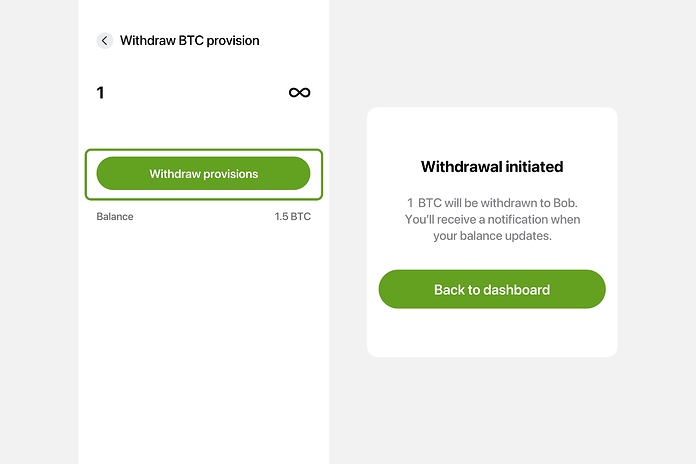

Enter the amount you wish to withdraw, and tap ‘Withdraw Provision’.

Rewards will be withdrawn instantly. To withdraw your original provisions, please allow up to 3 days. Please note that provision withdrawals for each currency can only be made one at a time – please wait for your withdrawal request to be processed before making another. You may make parallel requests across currencies.

We hope you enjoy the  Provide feature!

Provide feature!

For any queries about liquidity provision, personal feedback, or suggestions, you can tag @nickvasilich here or send an email to [email protected].