Where does it say that the liquidity and staking program rewards percentages were going to stay the same until December 31, 2020? I understood it was an introductory rewards program and it would change sometime, and to get the most out of it while I could?

[Finished] Liquidity rewards program v2

I believe, it is still profitable with current liquidity reward, as long as price movement up . I create a simple calculation on comment here, Liquidity pool loss?

The PL monday’s reward will affect the very near future.

The PL month’s reward will affect the near future.

(I’ve no medium talent espacially ^^)

@andrey

Imagine if we had a a liquidity token. When you buy it (with PRV), your money gets distributed into multiple liquidity pools. Maybe something like this.

Liquidity Distribution Breakdown

10% - pUSDT

20% - pUSDC

30% - pDAI

–

10% - pBTC

20% -pETH

30% -pXMR

These numbers are based on how much liquidity each coin has. Lower liquidity pools would be prioritized over higher ones. Only half your PRV would be invested in the pCoins listed above, the other half would be used to pair.

All the PRV gained from liquidity rewards go directly into increasing the price of the Token. You would be able to see your token increase in price, directly through the wallet. If you want to sell your token, your liquidity would be pulled out from each individual pool, and any potential loss would get eaten by the price of the Token.

Benefits of a system like this:

-Easy to invest in, all you need is some PRV.

-People are able to see their value increase in the wallet easily.

-Funds are allocated to the liquidity pools that need it the most.

-You could add staking functionality to the Token. For example, if you stake the liquidity token with PRV (1:1) you get slightly higher returns. We could lower current APY from 37% to 35%. When you stake together with the Token, your APY changes to 40%. So you would get bonus rewards in PRV on top of the value that your Token is gaining. This would be a very good incentive to keep your money locked up.

-Once cross pair liquidity providing is functional (no PRV), you would be able to exchange the Token for other crypto without the liquidity you provided needing to get withdrawn.

What do you think?

Call the token Liquid (LIQD), many people would invest in it.

The best part is, everything needed to create something like this is pretty much already functional. The only part would be automating it and potentially add the staking mechanic to it.

I was thinking about doing it myself, but I don’t think people would invest if it was all done manually.

This will probably not be a popular thought.

I think some simple changes could have the desired effect.

- State LP APR/Y in terms of the total pair. Even if you create that number by only looking at PRV always and only state the % in terms of the total.

(1a. Explain the downside protection as a selling point. But please show different scenarios as it’s not 50% but it’s more than anyone else is offering.) - Maximize the APR because we want to incentivize this behavior for the long term health of the entire project.

- Staking pool rewards should be less than LP rewards. The project doesn’t need the staking pool. People interested in one can go other places for this service. (Honestly, I initially wrote this point as end the staking pool, even though I use it heavily because it’s easier than adding liquidity.)

Once people can add liquidity by just adding PRV that will help.

If investors can furnish only PRV or only a specific token in LP, from where comes the liquidity of the other pair-side(bat,btc,usdx…)?

More generaly, i don’t understand to what serves staking PRV only, and what the goal of a pair balance different than 50/50.

@Josh_Hamon, @Tranbr

Well the idea was to convert 50% of the PRV to the various pCoins above, so you are providing half of your investment in pCoins as well as PRV. It goes on top of the current model. People would still be able to provide liquidity like normal, but if they want to invest in a token that automatically balances the liquidity to the most needed pools they can.

Personally I would rather invest in something like this if it was streamlined. If I can lock it up with PRV to gain slightly more rewards on my APY, even better. It’s nothing drastic and incentivizes you to keep your money in it. The benefits would include, eventually being able to take out your value directly from exchanging directly to other crypto instead of ‘withdrawing’ to PRV. Sure your still taking out liquidity from the network, but the impermanent losses aren’t getting carried over to the Token in this scenario.

I guess people rather get the rewards in PRV and automatically stake instead? Personally I think it would be cool to have the value of my Token that I invested in increase as my reward for providing. But then again, it’s optional, it’s not the only way to invest in liquidity.

If I’m gaining from the value of the Token as well as an extra PRV bonus from staking 1:1 with PRV, I wouldn’t want to sell anytime soon. This would make liquidity providing rewards go together with staking. That way if you want to stake, to maximize profits you would want to provide for liquidity too.

Great points! Yes, the staking pool should never provide higher APY over the Liquidity pool. Perhaps you also make a darn good point on the staking pool. Perhaps having 2 options for APY returns is a bit redundant. Maybe combine both pools? After pools have combined, maybe a good reason to think about lock periods for the liquidity pool. I have stated it before, but nothing rediculos just to help keep liquidity up.

It does not. Was not saying anywhere does it guarantee those returns for X amount of time. I read long ago it can change. The point was the change was known about, or at least could be seen. A heads up to those invested in the liquidity pool may have just added some peace of mind.

Like I said, true investors know the road in crypto investments, especially in one’s like incognito are gonna be rather rocky and to expect some rather bumpy roads for a while.

I was just mainly talking about the person you quoted. That person seems to think, or thought if you slapped the word APR on something, that means for the rest of that specific year the rewards rate will stay the same…which is just not how that works. That’s all I was pointing out.

Hi guys! Happy to share with you our latest updates

-

Pool was just released

-

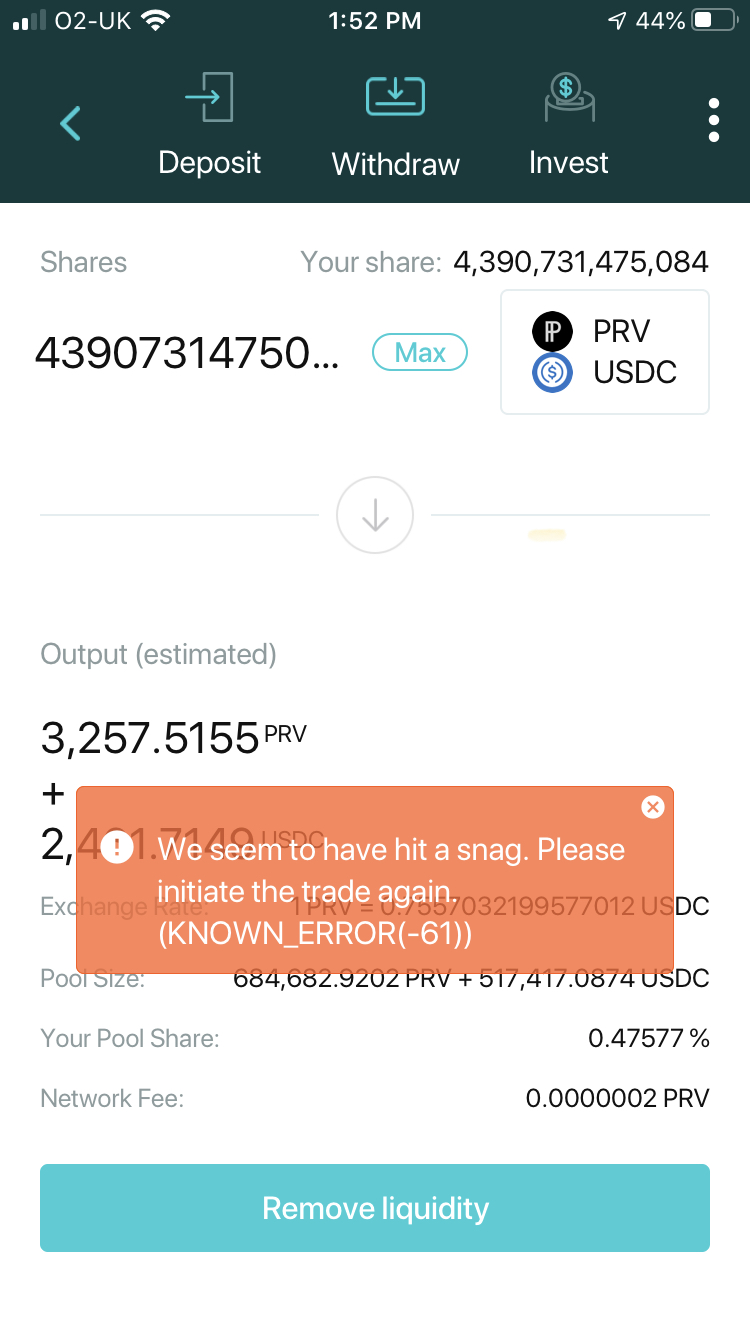

Feel free to start the migration of your funds from LP to Pool V2.

-

All users who provide liquidity during this week will get a reward as usual on Monday.

As always ideas and feedback on how to make our products better is more than Wellcome!

Hi @andrey. It looks like with the new Pool, each wallet is separate—is this intended to be indefinite, so one can keep funds segregated if necessary to reflect, for example, different investment sources/goals?

hey @jtmerchant - pool uses the same logic as pDEX (which should reduce the number of essential accounts/keychains), so people can more easily make choices – to do everything from one account, or keep stuff segregated as you said.

Hey guys! Today will be the last reward distribution for LP program V2.

If you would like to keep participate in providing liquidity, please go to Pool.